To access the submission as a PDF, click here.

Senate Finance and Public Administration Legislation Committee Via email: fpa.sen@aph.gov.au

The Northern Territory Council of Social Service (NTCOSS) is the peak body for the Northern Territory (NT) Community and Social Services Sector and is a voice for people affected by social and economic disadvantage and inequality. The community sector in the NT is made up of community managed, non- government, not-for-profit organisations that work in social and community service delivery, sector development and advocacy. The community sector plays a vital role in creating social wellbeing for all Territorians and in building safe and healthy communities by providing services that enable people to access and participate in health services, education, employment, economic development, and family and community life.

All people and communities should live a life free of poverty and disadvantage. NTCOSS advocates for measures to address cost of living pressures, such as reform to income support and welfare systems, in partnership with our members and key stakeholders.

NTCOSS represents a broad service sector and acknowledges member organisations with specific expertise on remote employment and community development in the NT. In particular, NTCOSS supports submissions by our Aboriginal Community-Controlled member organisations, and the Aboriginal Peak Organisations NT (APONT). NTCOSS also strongly supports APONT’s ‘Fair Work and Strong Communities: Proposal for a Remote Development and Employment Scheme’ and commends the recommendations in this proposal to the Committee.

While NTCOSS welcomes the opportunity to provide a submission to the Inquiry into the Social Services Legislation Amendment (Remote Engagement Program) Bill 2021 (the Bill), the timeframe for providing submissions is insufficient to adequately consult with our members. Given the short timeframe, please refer to preceding recommendations in NTCOSS submissions to:

- the Inquiry into the Social Services Legislation Amendment (Strengthening Income Support) Bill 2021 (Attachment A);

- the Senate Community Affairs Legislation Committee on the Social Security (Administration) Amendment (Continuation of Cashless Welfare) Bill 2020 (Attachment B);

- the Inquiry into the Social Services and Other Legislation Amendment (Extension of Coronavirus Support) Bill 2020 (Attachment C); and

- the Inquiry into the Adequacy of Newstart and related payments and alternative mechanisms to determine the level of income support payments in Australia 2019 (Attachment D).

Further to the recommendations in the above submissions, NTCOSS recommends that the Committee oppose the Bill.

NTCOSS welcomed the Australian Government’s decision to abolish the flawed Community Development Program and to develop a replacement scheme, to be co-designed with Aboriginal people and communities. However, despite this commitment, the proposed Bill has not been designed in collaboration or consultation with Aboriginal people, communities, and representative bodies, and it falls short of addressing the lack of access to paid employment in remote communities.

Under the National Agreement on Closing the Gap, the Australian Government committed to partnership and shared decision making with Aboriginal and Torres Strait Islander people. The Bill falls short of this commitment. In order to meet Closing the Gap targets, it is essential that genuine engagement and shared decision-making processes and principles are adhered to.

Under the proposed bill, workers in the pilot sites would not be afforded the rights and protections of other workers, including superannuation payments, and could still be subject to income management and payment penalties.

It is recommended that the Bill is rejected in favour APONT’s Fair Work and Strong Communities Proposal, which was designed by and with Aboriginal people, communities, representative bodies and social policy experts, and was endorsed by more 40 organisations. Central to the APONT proposal are opportunities to provide opportunities for paid employment, including in cultural, community, environment and economic development work, at award wages.

NTCOSS does not support the Bill, and instead recommends that the Government focus on investing in programs that benefit communities and address rates of unemployment in a meaningful way, through the adoption of the Fair Work and Stronger Communities Proposal.

Yours sincerely,

Deborah Di Natale CEO

5 March 2021

Senate Standing Committees on Community Affairs PO Box 6100

Parliament House Canberra ACT 2600

Via email: community.affairs.sen@aph.gov.au

Dear Committee Secretary,

Submission: Inquiry into the Social Services Legislation Amendment (Strengthening Income Support) Bill 2021

The Northern Territory Council of Social Service (NTCOSS) is the peak body for the Northern Territory (NT) Community and Social Services Sector and is a voice for people affected by social and economic disadvantage and inequality. The Community Sector in the NT is made up of community managed, non- government, not-for-profit organisations that work in social and community service delivery, sector development and advocacy. The Community Sector plays a vital role in creating social wellbeing for all Territorians and in building safe and healthy communities by providing services that enable people to access and participate in health services, education, employment, economic development, and family and community life.

All people and communities should live a life free of poverty and disadvantage. NTCOSS advocates for the relieving of cost of living pressures, such as reform to income support and welfare systems, in partnership with our members.

NTCOSS represents a broad service sector and acknowledges that a number of our member organisations with specific expertise in this area actively advocate in this space. In particular, NTCOSS supports submissions by our Aboriginal Community-Controlled member organisations (ACCOs).

NTCOSS endorses the submission and recommendations put forward to this inquiry by the Australian Council of Social Service (ACOSS).

NTCOSS welcomes the opportunity to provide a submission to the inquiry into the Social Services Legislation Amendment (Strengthening Income Support) Bill 2021 (the Bill). This submission reaffirms the position NTCOSS has previously taken in the preceding submissions to the inquiry into the Social Services and Other Legislation Amendment (Extension of Coronavirus Support) Bill 2020 (Attachment A) and to the inquiry into the Adequacy of Newstart and related payments and alternative mechanisms to determine the level of income support payments in Australia 2019 (Attachment B).

In summary, the key recommendations put forward in these previous submissions were as follows;

- the rate of JobSeeker and other income support payments is inadequate and needs to be urgently increased on a permanent basis;

- the success of the Coronavirus Supplement in keeping recipients out of poverty demonstrates the necessity of an ongoing permanent rate of income support that is higher than the current base rate;

- Aboriginal people living in remote communities should be able to access income support without having to meet more onerous conditions than those that are applied in urban centres; and

- the Community Development Program should be abolished and the Fair Work and Stronger Communities Proposal should be adopted.

Disappointingly, in the Bill the base rates of JobSeeker and related payments have not been sufficiently permanently increased by the Government, and meaningful reforms to address the inadequacies in our social security system have not been undertaken. The Federal Government has instead focused on delivering more restrictive and punitive measures (for example, the establishment of a hotline for employers to report those who decline employment offers), that will overwhelmingly and adversely impact Territorians.

The additional $550 per fortnight Coronavirus Supplement has made a significant impact on the lives of recipients, with people reporting an increased ability to meet basic needs, such as the ability to afford food, rent, warm clothing and other incidentals – something unachievable for many on base-rate payments of JobSeeker and Youth Allowance.1 Without the introduction of the Coronavirus Supplement and JobKeeper payments, an additional 2.2 million Australians would have entered into poverty during the pandemic.2 Conversely, its introduction has instead resulted in a marked decrease in the number of Australians living in poverty.3 The impact of the cessation of the Coronavirus Supplement on recipients, as well as the economy, cannot be understated, but despite this, the Government has disappointingly chosen to cease the Coronavirus Supplement on March 31 2021.

In its findings, the Poverty in Australia Report 2020 concluded that the single rate of Youth Allowance

- Australian Council of Social Service (ACOSS), Media Release “Community Service workers warn of dire consequences of planned cuts to

JobSeeker”, 26 August 2020, Strawberry Hills NSW

- Philips et al 2020; Phillips, B., Gray, M., and Biddle, N. (Australian National University Centre for Social Research and Methods 2020, COVID-19 JobKeeper and JobSeeker impacts on poverty and housing stress under current and alternative economic and policy scenarios, Australian National University, August 2020

- Ibid.

was $168 per week below the poverty line, while the single rate of JobSeeker was $117 per week below the poverty line, with no real permanent increase in the base rate of the JobSeeker payment in 25 years.4 While the Bill marks a permanent increase of $50 a fortnight ($3.60 a day), in the base rate of the JobSeeker payment, this increase is not enough to make a notable difference and is not in line with advice previously provided by community sector organisations such as NTCOSS and ACOSS.

The primary purpose of Australia’s social security system is to provide individuals with a ‘minimum adequate standard of living’.5 This includes adequate food, water and housing and the continuous improvement of living conditions.6 Ensuring the adequacy of social security payments to assist individuals in meeting this standard is of crucial importance in supporting those experiencing poverty and disadvantage in our communities. The introduction of the Coronavirus Supplement allowed recipients for the first time in many years to be able to meet this basic, adequate standard of living.

In line with the Raise the Rate for Good Campaign, NTCOSS recommends that JobSeeker and related payments need to be permanently increased by at least $25 a day (which would bring the JobSeeker rate to $65 a day), to enable people to live above the poverty line. With this in mind, the Government’s proposal of an increase of $3.60 a day is woefully inadequate and will keep people far below the poverty line, especially when combined with the impact of the cessation of the Coronavirus Supplement.

NTCOSS notes that of the poverty rates in Australia, people living in Remote or Very Remote localities experience much higher levels of poverty than those living in urban centres.7 These high rates of poverty are experienced disproportionately across the NT, with Aboriginal people in particular overrepresented in homelessness and unemployment rates, and poor educational outcomes.

The lack of any significant increase to base rates of income support payments on Territory communities is identified in NTCOSS Cost of Living reports. Remote areas are unfairly burdened by high costs relating to transport8 and increased rental costs9, prices have increased in key expenditure areas (such as utilities, education and health) and those living in the regions (and in particular in remote localities) pay substantially higher rates for produce and other food items.10 As a result, vulnerable people face further challenges with damaging effects on people’s health, social wellbeing and long term security, and poverty and disadvantage are becoming further entrenched in our communities.

Deloitte Access Economics has established that every dollar that the Government invests in JobSeeker

- Australian Council of Social Service (ACOSS) and the University of NSW Sydney (UNSW Sydney), Poverty in Australia 2020, Part 1:Overview, Strawberry Hills NSW

- Australian Government, Australian Law Reform Commission, 2012 ‘Australia’s social security system’, September 2019,

https://www.alrc.gov.au/publication/grey-areas-age-barriers-to-work-in-commonwealth-laws-dp-78/5-social-security/australias-social- security- system/

- Australian Government – Attorney-General’s Department, ‘Right to an adequate standard of living, including food, water and housing’ viewed September 2019 https://www.ag.gov.au/RightsAndProtections/HumanRights/Human-rights- scrutiny/PublicSectorGuidanceSheets/Pages/Righttoanadequatestandardoflivingincludingfoodwaterandhousing.aspx

- Parliament of Australia, The impact of COVID-19 on JobSeeker Payment recipient numbers by electorate, September 2020, viewed November 2020, available at https://www.aph.gov.au/About_Parliament/Parliamentary_Departments/Parliamentary_Library/pubs/rp/rp2021/COVID- 19JobSeekerRecipientNumbersElectorateUpdate#_Toc49850898

- NTCOSS, 2018 Cost of Living Report – Issue 21 9 NTCOSS, 2019, Cost of Living Report – Issue 23 10 NTCOSS, 2019, Cost of Living Report – Issue 24

generates significant economic return, with analysis showing that the Government’s reductions to

income support would set the economy back in a time of recession.11

Along with the measurable economic benefits that come with higher payment rates of social security, increasing the rate of payments would have positive impacts in numerous other areas. The Health of Disability Support Pension and Newstart Allowance Recipients report by Monash University found that there is a significantly increased burden of ill health within the cohort of Australian Newstart recipients (and Disability Support Pension recipients) compared to employed people of working age. Poverty and financial pressure directly correlate to poor health outcomes and the reduced ability to engage and participate in employment. Health (and in particular mental health) can be improved by reducing the burden of engaging with Government.12 Despite this, and despite having one of the strictest income support compliance systems amongst comparable countries, the Government has announced increased Mutual Obligations for JobSeeker recipients including an increase in job searches from the current 8, to 20 by July 1 2021.13

These latest changes to Mutual Obligations are unnecessarily punitive and will create further hardship for recipients without improving their job prospects. Punitive measures like these, in line with programs such as the Community Development Program, do not address larger structural issues such as the deficit of jobs in the NT, especially in remote communities, nor do they help to develop the labour market. In January 2021, there were 23,508 people on JobSeeker and Youth Allowance in the NT14, and only 2000 jobs advertised15. Such statistics indicate that there is a larger structural issue at play, which will not be rectified by punishing JobSeeker recipients if they do not increase the number of job searches they are undertaking.

Along with increased Mutual Obligations, the Bill outlines the intent to establish a hotline to enable employers and Employment Services Providers to report JobSeeker recipients who decline job offers. The evidence presented for this hotline at the relevant press conference was anecdotal.16 Currently, any potentially productive outcome of this hotline is unclear, and so NTCOSS recommends that the Government present a clear evidence base supporting this hotline prior to moving forward with it. A blanket approach to this issue has potential complications (for example a job may appear appropriate on paper but may have exploitative conditions or an employer who behaves inappropriately, and these are valid reasons to decline a job offer). As such, without further evidence being presented this hotline appears to be unnecessarily punitive and without adequate justification. Punitive measures like this have the potential to actively cause harm to vulnerable people. Instead, the Government should be focusing on developing productive programs which create jobs for people in rural and remote areas

- NTCOSS, Media Release: Cuts to JobSeeker to cost the NT economy $348 million – Deloitte report, September 2020, available at https://ntcoss.org.au/category/media-releases/

- Ibid.

- ACOSS, Media Release, “A heartless betrayal of millions – Government JobSeeker decision“, 23 February 2021, Strawberry Hills NSW

- Australian Government, Department of Social Services, ‘JobSeeker Payment and Youth Allowance recipients – monthly profile’, January 2021, available at https://data.gov.au/data/dataset/jobseeker-payment-and-youth-allowance-recipients-monthly- profile#:~:text=The%20%E2%80%9CJobSeeker%20Payment%20and%20Youth,and%20Youth%20Allowance%20(other).&text=The%20report%20includ

es%20payment%20recipient,and%20Statistical%20Area%20Level%202.

- Australian Government, Vacancy Report: Labour Market Information Portal, January 2021, available at https://lmip.gov.au/default.aspx?LMIP/GainInsights/VacancyReport

- Prime Minister of Australia, Press Conference Transcript, 23 February 2021, Canberra, ACT

such as the Fair Work and Stronger Communities Proposal.

NTCOSS does not support the Bill, and instead recommends that the rate of JobSeeker, Youth Allowance and other related payments be increased permanently and adequately as recommended by ACOSS through the Raise the Rate for Good Campaign. Additionally, in relation to the NT, NTCOSS recommends that the Government remove punitive measures that unfairly impact and stigmatise cohorts within the Territory (as referred to in the submission to the inquiry into the Adequacy of Newstart and related payments and alternative mechanisms to determine the level of income support payments in Australia 2019) (Attachment B). NTCOSS also recommends that the Government reconsider unnecessarily punitive measures such as the proposed hotline and instead focus on investing in programs that benefit communities and address rates of unemployment in a meaningful way (such as through the abolishment of the CDP and adoption of the Fair Work and Stronger Communities Proposal).

Yours sincerely,

Deborah Di Natale CEO

NTCOSS Submission to the Senate Community Affairs Legislation Committee on the Social Security (Administration) Amendment (Continuation of Cashless Welfare) Bill 2020

October 2020

Northern Territory Council of Social Service (NTCOSS)

The Northern Territory Council of Social Service (NTCOSS) is the peak body for the Northern Territory (NT) Community and Social Services Sector and is a voice for people affected by social and economic disadvantage and inequality. The Community Sector in the NT is made up of community managed, non-government, not-for-profit organisations that work in social and community service delivery, sector development and advocacy. The Community Sector plays a vital role in creating social wellbeing for all Territorians and in building safe and healthy communities by providing services that enable people to access and participate in health services, education, employment, economic development, and family and community life.

NTCOSS believes that all people and communities should live a life free of poverty and disadvantage. NTCOSS advocates for the relieving of cost of living pressures, such as reform to income support and welfare systems, in partnership with our members.

NTCOSS represents a varied service sector and acknowledges that a number of our member organisations with specific expertise in this area have also provided submissions to this inquiry and the previously conducted Senate Community Affairs Legislation Committee Social Security (Administration) Amendment (Income Management to Cashless Debit Card Transition) Bill 2019. In particular, NTCOSS supports new and previous submissions by our Aboriginal Community- Controlled member organisations (ACCOs), including Tangentyere Council. NTCOSS also supports the detailed submission and recommendations provided by the Aboriginal Peak Organisations Northern Territory (APO NT).

Background

While NTCOSS welcomes the opportunity to provide a submission to the Senate Community Affairs Legislation Committee on the Social Security (Administration) Amendment (Continuation of Cashless Welfare) Bill 2020 (the Bill), this submission will reaffirm the position NTCOSS has previously taken in a previous submission to the Senate Community Affairs Legislation Committee Social Security (Administration) Amendment (Income Management to Cashless Debit Card Transition) Bill 2019.

In summary, the position put forward in the previous submission was as follows;

- NTCOSS does not support the passage of the Bill and the expansion of compulsory Income Management (IM).

- Considering that any changes to IM in the NT disproportionately impact Aboriginal people, and particularly those living in remote localities, it is essential that any programs

and service delivery for Aboriginal people recognise their sovereignty, and that Aboriginal people and communities have control and agency over matters affecting them.

- IM should be on an opt-in basis.

- That the Government raise the rate of Newstart (now JobSeeker) and related payments and focus on addressing rates of unemployment, inequality and poverty through addressing the social determinants of health.

- That funds allocated for the implementation of the Cashless Debit Card (CDC) trial in the NT be reinvested in communities to address the causative factors of disadvantage and poverty, prioritising ACCOs to deliver such programs.

- That any future trials or iterations of the CDC and IM be subject to rigorous and independent evaluation processes.

NTCOSS is concerned that, a year later, adequate steps have not been taken to address the above, while further changes put forward in the Bill have the capacity to stigmatise and harm communities. NTCOSS does not support the Bill and urges the Government to instead invest in policies that acknowledge and support the importance of community agency. Meaningful co- design and self-determination must be a cornerstone of any future policy.

Impact of IM and CDC in the NT

The NT is home to the highest proportion of Aboriginal people in Australia, with more than 100 languages and dialects spoken across the region.17 Data from March 2018 shows that there are over 22,000 people on IM in the NT, with 82% of this population identified as Aboriginal; the majority of who are recognised as long term welfare recipients.18

Of the poverty rates in Australia, people living in Remote or Very Remote localities experience much higher levels of poverty than those living in urban centres.11 These high rates of poverty are experienced disproportionately across the NT, with Aboriginal people in particular overrepresented in homelessness and unemployment rates, and poor educational outcomes. As a result of this, people experiencing vulnerability face further challenges with damaging effects on health, social wellbeing and long-term security, and poverty and disadvantage becoming further entrenched in our communities.

As reported by the Australian Council of Social Service (ACOSS),19 the original purpose of IM was to stem the flow of cash that is expended on substance abuse and gambling, and to ensure funds that are provided for the welfare of children are expended appropriately.20 Despite this, there is little evidence to support that IM has successfully achieved these goals.

IM in the NT was evaluated between 2010 and 2014,21 with key points from the report highlighting;

- “Very little progress in addressing many of the substantial disadvantages faced by many people in the Northern Territory”;

- “No evidence to indicate that income management has an effect at the community level,

nor that income management, in itself, facilitates long-term behavioural change”;

- The cohort of individuals most interested in continuing IM were undertaking it on a voluntary basis;

- It is much harder for Aboriginal people to exit IM, especially those in remote communities; and

17 Australian Bureau of Statistics, 2016 Census QuickStats, Northern Territory https://quickstats.censusdata.abs.gov.au/census_services/getproduct/census/2016/quickstat/7?opendocument accessed 18th June 2019; Aboriginal languages in NT https://nt.gov.au/community/interpreting-and-translating- services/aboriginal-interpreter-service/aboriginal-languages-in-nt, accessed 18th June 2019

18 Australian Government, 2018, Income Management and Cashless Debit Card Summary, October 2019, accessed at https://data.gov.au/dataset/ds-dga-3b1f1fb7-adb5-48ea-8305-9205df0a298c/distribution/dist-dga-986ef7fe- 1ba8-460e-b1c4-2cf00145a948/details?q=

19 Australian Council of Social Service (ACOSS), Cashless Debit Card and Income Management Briefing Note 2020

20 Explanatory Memorandum, Social Security and Other Legislation (Welfare Payment Reform) Bill 2007, p. 5

21 Bray et al. 2014, Evaluating New Income Management in the Northern Territory, UNSW, Social Policy Research Centre

- Rather than building capacity and independence, for many people on compulsory IM, it has made them more dependent on the Government.

Further to the above, IM in the NT has reportedly had a negative impact on key indicators of health, including birth weights. In a paper delivered at the National Bureau for Economic Research Indigenous Health, Wellbeing, and Children’s Outcomes workshop in Boston in November 2019, researchers identified an average drop in birth weights for IM participants of more than 100 grams, with a 30 percent greater likelihood of a low birth-weight outcome of that scale compared to prior to the 2007 Intervention and the introduction of IM.22 Other research has not found conclusive evidence that IM has positively impacted social and health outcomes, including school attendance.23

Additionally, a joint study released by the University of Queensland on four CDC trial sites found that the majority of recipients reported to not have a problem with drugs, alcohol or other dependencies before entering onto the card, and that the majority of respondents did not see any benefit to the scheme and reported negative consequences of being moved onto it, such as not having enough cash to pay for essential items.24

The Australian National Audit Office (ANAO) found that the Department of Social Services (DSS) had taken an inadequate approach to monitoring and evaluation regarding the CDC trials in a 2018 report,25 stating that as a consequence of this, it was difficult to determine whether the CDC trials resulted in a reduction of social harms or it if was a lower cost welfare quarantining approach.

One of the original authors of the evaluation of IM in the Northern Territory, who has since also been responsible for a number of other reviews regarding income quarantining, put forward that the positive effects identified by some evaluations are opinion-based, and not supported by relevant data measuring health and wellbeing outcomes related to the policy’s objectives.26

22 Doyle, M., Schurer, S., & Silburn, S. (2019). Why does income quarantining worsen birth outcomes in indigenous communities?, Conference paper for presentation at the NBER workshop Indigenous Health, Wellbeing, and Children’s Outcomes, Boston Massachusetts, November 2019. University of Sydney, Institute for the Study of Labour, Menzies School of Health Research; APO NT, Submission to the Senate Community Affairs Legislation Committee on the Social Security (Administration) Amendment (Continuation of Cashless Welfare) Bill 2020

23 Clark, D., Kettlewell, N., Schurer, S., & Silburn, S. (2017). The effect of quarantining welfare on school attendance in Indigenous communities. Life Course Centre Working Paper Series. https://www.lifecoursecentre.org.au/wp-content/uploads/2018/06/2017-22-LCC-Working-Paper-Cobb-Clark-et- al..pdf

24 Marston, G., Mendes, P., Bielefeld, S., Peterie, M., Staines, R., & Roche, S. (2020). Hidden costs: An independent study into Income Management in Australia. University of Queensland. https://research.monash.edu/en/publications/hidden-costs-an-independent-study-into-income-management-in- austr

25 Australian National Audit Office, 2018, The Implementation and Performance of the Cashless Debit Card Trial

26 Bray, R. J. (2016) ‘Seven years of evaluating income management – what have we learnt? Placing the findings of

While there may be anecdotal reports of positive outcomes from IM, there is no conclusive, data- driven analysis relating to IM in the NT and other CDC trial sites. Considering Government plans to roll the CDC out on a permanent basis in the NT, with no cap on participants (impacting over 22,000 people), it is of great concern that a top-down, blanket approach is being taken regarding people’s welfare.

Community Leadership and Co-Design

The National Agreement on Closing the Gap includes priority reform areas that focus on transforming the way governments work with and for Aboriginal people to improve outcomes. The priority areas of reform focus on areas such as shared decision making and embedding ownership; developing the capacity of ACCOs; and ensuring government agencies and institutions undertake systemic and structural transformation to better contribute to Closing the Gap, while improving accountability.27

Noted concerns regarding the expansion of the CDC into the NT include lack of meaningful consultation with communities, no remote jobs development and the refusal to introduce the CDC on an opt-in basis.28 A permanent, blanket imposition of the CDC on the NT, without addressing these concerns, goes against the principles set out in the National Agreement on Closing the Gap.

IM was first introduced in the NT as part of the 2007 Northern Territory Emergency Response (NTER). The NTER required the suspension of the Racial Discrimination Act 1975 to explicitly target all Aboriginal and Torres Strait Islander people on welfare.29 New Income Management (NIM) was introduced to replace IM under the NTER in 2010, which included reinstating the Racial Discrimination Act, meaning non-Indigenous people were included.

Despite the reintroduction of the Racial Discrimination Act, CDC trial sites in Ceduna and the East Kimberley have disproportionately targeted Aboriginal people.30 The Parliamentary Joint Committee on Human Rights found that the IM measures are likely to disproportionately impact

the New Income Management in the Northern Territory evaluation in context’, Australian Journal of Social Issues Vol.51 No.4, p. 464; Australian Council of Social Service (ACOSS), Cashless Debit Card and Income Management Briefing Note 2020

27 Closing the Gap In Partnership, National Agreement on Closing the Gap: At a Glance, viewed October 2020, accessed at https://www.closingthegap.gov.au/national-agreement-closing-gap-glance

28 Attachment A; APO NT, Submission to the Senate Community Affairs Legislation Committee Social Security (Administration) Amendment (Income Management to Cashless Debit Card Transition) Bill 2019; APO NT, Submission to the Senate Community Affairs Legislation Committee on the Social Security (Administration) Amendment (Continuation of Cashless Welfare) Bill 2020

29 Klein E and Razi S, 2017, The Cashless Debit Card Trial in the East Kimberley

30 Ibid.

on Aboriginal people and therefore may be indirectly discriminatory.31 Aboriginal people continue to make up the overwhelming majority of IM participants,32 with national and international human rights bodies expressing concern regarding the targeting of Aboriginal people by IM.33 The United Nations Committee on the Elimination of Racial Discrimination has previously raised concerns around the discrimination faced by Aboriginal and Torres Strait Islander people and recommended that Australia maintain only opt-in forms of social security quarantining.34

Remote Employment

The number of Aboriginal people receiving welfare on a long term basis can be directly correlated with the failure to close the employment gap and address the underlying causative factors of unemployment in remote areas35 (i.e. lack of appropriate employment opportunities that take into account mobility, flexible working practices that accommodate cultural obligations and lack of training opportunities). The Australian Bureau of Statistics (ABS) found that the proportion of Aboriginal people in remote areas who are employed has stalled or is decreasing,36 meaning that people are increasingly reliant on government payments.

Not only are these payments severely inadequate,37 but IM does not focus on capacity building

31 Parliamentary Joint Committee on Human Rights, Human Rights Scrutiny Report, Report no 27/2015, 8 September 2015; Parliamentary Joint Committee on Human Rights, Human Rights Scrutiny Report, Report no 9/2017, 5 September 2017

32 Bray et al. 2014, Evaluating New Income Management in the Northern Territory

33 United Nations Committee on the Elimination of Racial Discrimination, 2017, Concluding observations on the eighteenth to twentieth periodic reports of Australia, October 2019, accessed at https://tbinternet.ohchr.org/Treaties/CERD/Shared%20Documents/AUS/CERD_C_AUS_CO_18-20_29700_E.pdf; Australian Human Rights Commission, 2017, submission No 30 to the Senate Community Affairs Legislation Committee – Inquiry into the Social Services Legislation Amendment (Cashless Debit Card) Bill, October 2019, accessed at https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Community_Affairs/CashlessDebitCard/Su bmissions

34 APO NT, Submission to the Senate Community Affairs Legislation Committee on the Social Security (Administration) Amendment (Continuation of Cashless Welfare) Bill 2020; United Nations Committee on the Elimination of Racial Discrimination, (2017) Concluding Observations on the eighteenth to twentieth periodic reports of Australia, UN doc CERD/C/AUS/CO/18-20 (8 December 2017) [23]

35 Central Australian Aboriginal Congress, 2019, Submission to the Senate Inquiry into the Adequacy of Newstart and Related Payments and Alternative Mechanisms to Determine the Level of Income Support Payments in Australia

36 Australian Bureau of Statistics, 2015, National Aboriginal and Torres Strait Islander Social Survey 2014-15, http://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/4714.0201415?OpenDocument#Publications

37 NTCOSS, 2019, Submission to the Senate Inquiry into the Adequacy of Newstart and Related Payments and Alternative Mechanisms to Determine the Level of Income Support Payments in Australia (public);

Australian Council of Social Service (ACOSS), 2019, Submission to the Senate Inquiry into the Adequacy of Newstart and Related Payments and Alternative Mechanisms to Determine the Level of Income Support Payments in Australia – Surviving, not living: the (in)adequacy of Newstart and related payments; Central Australian Aboriginal Congress, 2019, Submission to the Senate Inquiry into the Adequacy of Newstart and Related Payments and Alternative Mechanisms to Determine the Level of Income Support Payments in Australia

and independence and has been attributed to making people more dependent on welfare.38

This deficit of jobs in remote communities is further impeded by the Community Development Program (CDP). The CDP is a further example of punitive, paternalistic and stigmatising policy that overwhelmingly impacts Aboriginal people living in remote and rural areas.

There are around 35,000 CDP participants, of whom roughly 80% are identified as Aboriginal and living in remote communities.39 CDP participants are 25 times more likely to be penalised for non-compliance than non-remote job seekers, and 50 times more likely to have a penalty imposed on them for ‘persistent non-compliance’ (up to 8 weeks).40 Since the introduction of the CDP, incidences of poverty crime have reportedly increased, including; breaks in (predominantly committed by children) to steal food, an increase in domestic and family violence, financial coercion, increases in mental health problems and hunger.41

Further, those who have been penalised for not meeting CDP requirements were found to go for longer periods without income than those in urban areas and were less likely to be exempted from programs on medical grounds, ‘despite a much higher burden of disease in remote Aboriginal communities.42 The most penalised cohort were men aged under 35 who had lower English literacy levels, lower education level, limited online access to deal with Centrelink and less mobility.

Along with the punitive and harmful aspects of the CDP, it does not address the deficit of jobs in remote communities and does not focus on developing the labour market, instead acting as penalising welfare program. Fair Work and Strong Communities (Attachment B) is a proposal for a remote development and employment scheme, that would create up to 5,000 jobs in communities by providing wage packages to enable ACCOs to take on new workers.43 As APO NT states “creating real jobs in real communities will have a far more positive impact on the lives of Aboriginal people than continuing and expanding compulsory IM.”44

38 Bray et al. 2014, Evaluating New Income Management in the Northern Territory

39 Department of the Prime Minister and Cabinet, ‘An evaluation of the first two years of the Community

Development Programme’, accessed at https://www.pmc.gov.au/sites/default/files/publications/cdp-evaluation- first-2-years.pdf

40 The Guardian, Work for the Dole an ‘intergenerational time bomb’ for Indigenous Communities, viewed September 2019, accessed at https://www.theguardian.com/australia-news/2018/oct/11/work-for-the-dole-an- intergenerational-time-bomb-for-indigenous-communities

41 Australian Government, National Indigenous Australian Agency, 2019, ‘The many pathways of the Community

Development Programme’

42 Department of the Prime Minister and Cabinet, An evaluation of the first two years of the Community Development Programme

43 APO NT, Submission to the Senate Community Affairs Legislation Committee on the Social Security (Administration) Amendment (Continuation of Cashless Welfare) Bill 2020

44 Ibid.

As opposed to directing spending towards punitive programs with no strong evidence as to their success, the Australian Government needs to invest in programs that are driven by communities and for communities that will result in long term, beneficial outcomes.

Access

As established in the previous submission to Senate Community Affairs Legislation Committee Social Security (Administration) Amendment (Income Management to Cashless Debit Card Transition) Bill 2019 (Attachment A), NTCOSS holds specific concerns regarding the Minister’s powers to alter the percentage of a payment that is quarantined.

While the majority of people on IM in the NT have 50 per cent of their payment restricted (70 per cent for those on the child protection measure), and this will reportedly be maintained under the CDC, the new Bill grants the Minister the ability to alter this percentage up to 80 per cent with limited scrutiny.

Considering all other CDC sites have 80 per cent of participants’ payments quarantined, NTCOSS holds concerns regarding the Government’s commitment to maintain the NT as 50 percent. Quarantining larger portions of payments further limits people’s ability to access cash and ability to purchase essential items in the cash economy (such as second-hand goods).

Further, technical issues impacting access to services in remote communities mean that participants are restricted not only in using the card if electronic payment methods are not functioning, but accessing support services in replacing lost or stolen cards as well as applying to exit IM as a participant. As established by APO NT, internet and mobile phone coverage are not guaranteed in communities, technological proficiency is not high and English can be a third or fourth language for many.45 With limited support from Centrelink and access to a single phone for queries and complaints, there are significant challenges for people living remotely.46

This is significant not just in terms of access to money, but also in terms of impeding on participants ability to seek an exemption from participating in the program. The exemption process, as established in the Cashless Debit Card Exit Application form,47 largely relies on an individual’s ability to have reliable access to telecommunications and liaise with the Department.48 Noting the low rate of exemptions for Aboriginal participants applying to

45 APO NT, Submission to the Senate Community Affairs Legislation Committee on the Social Security (Administration) Amendment (Continuation of Cashless Welfare) Bill 2020

46 Ibid.

47 Australian Government. (2020). Cashless Debit Card Exit Application form (SS526), https://www.servicesaustralia.gov.au/individuals/forms/ss526

48 APO NT, Submission to the Senate Community Affairs Legislation Committee on the Social Security (Administration) Amendment (Continuation of Cashless Welfare) Bill 2020

successfully be removed from compulsory IM in the NT,49 with only 4.9% succeeding upon application to exit IM compared to non-Indigenous people,50 introducing further obstacles that impede on an individual’s ability to navigate this process is of great concern. Considering Aboriginal people make up the overwhelming majority of IM recipients, and reports that those who voluntarily partake in IM are the cohort of people who are most interested in continuing it, it seems punitive to expand the CDC in line with the amendments outlined in the Bill.

NTCOSS also echoes Tangentyere Council’s concerns regarding the introduction of the CDC and its management by Indue, particularly noting concerns around the lack of a shopfront, the introduction of a new financial institution and concerns regarding the compliance and security regulations that they are expected to comply with, along with lack of digital accessibility.51

Conclusion

In summary, NTCOSS does not support the passage of the Bill and the expansion of the CDC. NTCOSS reiterates the position that:

- Considering any changes to IM in the NT disproportionately impact Aboriginal people, and particularly those living in remote localities, it is essential that any programs and service delivery for Aboriginal people recognise their sovereignty, and that Aboriginal people and communities have control and agency over matters affecting them.

- IM should be on an opt-in basis.

- That the Government raise the rate of JobSeeker and related payments and focus on addressing rates of unemployment, inequality and poverty through addressing the social determinants of health.

- That funds allocated for the implementation of the CDC trial in the NT be reinvested in communities to address the causative factors of disadvantage and poverty, prioritising ACCOs to deliver such programs.

- That any future trials or iterations of the CDC and IM be subject to rigorous and independent evaluation processes.

- The Government abolishes the CDP and adopts the Fair Work and Stronger Communities Proposal (Attachment B).

49 Bray et al. 2014, Evaluating New Income Management in the Northern Territory

50 Ibid.

51 Tangentyere Council, Senate Inquiry into the Social Security Amendment Bill 2019 – Income Management to Cashless Debit Card Transition, 2019

References

- APO NT, Submission to the Senate Community Affairs Legislation Committee on the Social Security (Administration) Amendment (Continuation of Cashless Welfare) Bill 2020

- APO NT, Submission to the Senate Community Affairs Legislation Committee Social Security (Administration) Amendment (Income Management to Cashless Debit Card Transition) Bill 2019

- Australian Bureau of Statistics, 2015, National Aboriginal and Torres Strait Islander Social Survey 2014-15, http://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/4714.0201415?OpenDocument#Publications

- Australian Bureau of Statistics, 2016 Census QuickStats, Northern Territory

- Australian Council of Social Service (ACOSS), 2019, Submission to the Senate Inquiry into the Adequacy of Newstart and Related Payments and Alternative Mechanisms to Determine the Level of Income Support Payments in Australia – Surviving, not living: the (in)adequacy of Newstart and related payments;

- Australian Council of Social Service (ACOSS), Cashless Debit Card and Income Management Briefing Note 2020

- Australian Government, 2018, Income Management and Cashless Debit Card Summary, October 2019, accessed at https://data.gov.au/dataset/ds-dga-3b1f1fb7-adb5-48ea-8305- 9205df0a298c/distribution/dist-dga-986ef7fe-1ba8-460e-b1c4-2cf00145a948/details?q=

- Australian Government, National Indigenous Australian Agency, 2019, ‘The many pathways of the Community Development Programme’

- Australian Government. (2020). Cashless Debit Card Exit Application form (SS526), https://www.servicesaustralia.gov.au/individuals/forms/ss526

- Australian Human Rights Commission, 2017, submission No 30 to the Senate Community Affairs Legislation Committee – Inquiry into the Social Services Legislation Amendment (Cashless Debit Card) Bill, October 2019, accessed at https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Community_Affairs/CashlessDebit Card/Submissions

- Australian National Audit Office, 2018, The Implementation and Performance of the Cashless Debit Card Trial

- Bray et al. 2014, Evaluating New Income Management in the Northern Territory, UNSW, Social Policy Research Centre

- Bray, R. J. (2016) ‘Seven years of evaluating income management – what have we learnt? Placing the findings of the New Income Management in the Northern Territory evaluation in context’, Australian Journal of Social Issues Vol.51 No.4, p. 464

- Central Australian Aboriginal Congress, 2019, Submission to the Senate Inquiry into the Adequacy of Newstart and Related Payments and Alternative Mechanisms to Determine the Level of Income Support Payments in Australia

Clark, D., Kettlewell, N., Schurer, S., & Silburn, S. (2017). The effect of quarantining welfare on school attendance in Indigenous communities. Life Course Centre Working Paper Series. https://www.lifecoursecentre.org.au/wp-content/uploads/2018/06/2017-22-LCC-Working-Paper-Cobb- Clark-et-al..pdf

- Closing the Gap In Partnership, National Agreement on Closing the Gap: At a Glance, viewed October 2020, accessed at https://www.closingthegap.gov.au/national-agreement-closing-gap-glance

- Department of the Prime Minister and Cabinet, ‘An evaluation of the first two years of the Community Development Programme’, accessed at https://www.pmc.gov.au/sites/default/files/publications/cdp- evaluation-first-2-years.pdf

- Department of the Prime Minister and Cabinet, An evaluation of the first two years of the Community Development Programme

- Doyle, M., Schurer, S., & Silburn, S. (2019). Why does income quarantining worsen birth outcomes in Indigenous communities?, Conference paper for presentation at the NBER workshop Indigenous Health, Wellbeing, and Children’s Outcomes, Boston Massachusetts, November 2019. University of Sydney, Institute for the Study of Labour, Menzies School of Health Research;

- Explanatory Memorandum, Social Security and Other Legislation (Welfare Payment Reform) Bill 2007, p. 5 https://quickstats.censusdata.abs.gov.au/census_services/getproduct/census/2016/quickstat/7?opendo cument accessed 18th June 2019; Aboriginal languages in NT https://nt.gov.au/community/interpreting- and-translating-services/aboriginal-interpreter-service/aboriginal-languages-in-nt, accessed 18th June

2019

- Klein E and Razi S, 2017, The Cashless Debit Card Trial in the East Kimberley

Marston, G., Mendes, P., Bielefeld, S., Peterie, M., Staines, R., & Roche, S. (2020). Hidden costs: An independent study into Income Management in Australia. University of Queensland https://research.monash.edu/en/publications/hidden-costs-an-independent-study-into-income- management-in-austr

- NTCOSS, 2019, Submission to the Senate Inquiry into the Adequacy of Newstart and Related Payments and Alternative Mechanisms to Determine the Level of Income Support Payments in Australia (public)

- Parliamentary Joint Committee on Human Rights, Human Rights Scrutiny Report, Report no 27/2015, 8 September 2015; Parliamentary Joint Committee on Human Rights, Human Rights Scrutiny Report, Report no 9/2017, 5 September 2017

- Tangentyere Council, Senate Inquiry into the Social Security Amendment Bill 2019 – Income Management to Cashless Debit Card Transition, 2019

- The Guardian, Work for the Dole an ‘intergenerational time bomb’ for Indigenous Communities, viewed September 2019, accessed at https://www.theguardian.com/australia-news/2018/oct/11/work-for-the- dole-an-intergenerational-time-bomb-for-indigenous-communities

- United Nations Committee on the Elimination of Racial Discrimination, 2017, Concluding observations on the eighteenth to twentieth periodic reports of Australia, October 2019, accessed at https://tbinternet.ohchr.org/Treaties/CERD/Shared%20Documents/AUS/CERD_C_AUS_CO_18- 20_29700_E.pdf;

- United Nations Committee on the Elimination of Racial Discrimination, (2017) Concluding Observations on the eighteenth to twentieth periodic reports of Australia, UN doc CERD/C/AUS/CO/18-20 (8 December 2017) [23]

20 November 2020

Senate Standing Committees on Community Affairs PO Box 6100

Parliament House Canberra ACT 2600

Via email: community.affairs.sen@aph.gov.au

Dear Committee Secretary,

Submission: Inquiry into the Social Services and Other Legislation Amendment (Extension of Coronavirus Support) Bill 2020

The Northern Territory Council of Social Service (NTCOSS) is the peak body for the Northern Territory (NT) Community and Social Services Sector and is a voice for people affected by social and economic disadvantage and inequality. The Community Sector in the NT is made up of community managed, non- government, not-for-profit organisations that work in social and community service delivery, sector development and advocacy. The Community Sector plays a vital role in creating social wellbeingfor all Territorians and in building safe and healthy communities by providing services that enable people to access and participate in health services, education, employment, economic development, and family and community life.

All people and communities should live a life free of poverty and disadvantage. NTCOSS advocates for the relieving of cost of living pressures, such as reform to income support and welfare systems, in partnership with our members.

NTCOSS represents a broad service sector and acknowledges that a number of our member organisations with specific expertise in this area actively advocate in this space, and has previously provided submissions to the inquiry into the Adequacy of Newstart and related payments and alternative mechanisms to determine the level of income support payments in Australia 2019. In particular, NTCOSS supports submissions by our Aboriginal Community-Controlled member organisations (ACCOs), including Tangentyere Council and Central Australian Aboriginal Congress.

NTCOSS endorses the submission and recommendations put forward to this inquiry by the Australian Council of Social Service (ACOSS).

While NTCOSS welcomes the opportunity to provide a submission to the Inquiry into the Social Services and Other Legislation Amendment (Extension of Coronavirus Support) Bill 2020 (the Bill), this submission reaffirms the position NTCOSS has previously taken in the preceding submission to the inquiry into the Adequacy of Newstart and related payments and alternative mechanisms to determine the level of income support payments in Australia 2019 (Attachment A).

In summary, the key recommendations put forward in this previous submission were as follows;

- The rate of Newstart (now JobSeeker) and other income support payments is inadequate and needs to be urgently increased on a permanent basis;

- Aboriginal people living in remote communities should be able to access income support without having to meet more onerous conditions than those that are applied in urban centres; and

- The Community Development Program should be abolished and the Fair Work and Stronger Communities Proposal1 should be adopted.

Disappointingly, over a year later, the base rates of these payments have not been permanently increased by the Government, and meaningful reforms to address the inadequacies in our social security system have not been undertaken. The Federal Government has instead focused on delivering more restrictive measures (for example, the permanent expansion of the cashless welfare system) that will overwhelmingly and adversely impact Territorians.

The additional $550 per fortnight Coronavirus Supplement has made a significant impact on the lives of recipients, with people reporting an increased ability to meet basic needs, such as the ability to afford food, rent, warm clothing and other incidentals – something unachievable for many on base- rate payments of JobSeeker and Youth Allowance.2 In its findings, the Poverty in Australia Report 2020 concluded that the single rate of Youth Allowance was $168 per week below the poverty line, while the single rate of JobSeeker was $117 per week below the poverty line, with no real permanent increase in the base rate of the JobSeeker payment in 25 years.3

The primary purpose of Australia’s social security system is to provide individuals with a ‘minimum adequate standard of living’.4 This includes adequate food, water and housing and to the continuous improvement of living conditions.5 Ensuring the adequacy of social security payments to assist individuals in meeting this standard is of crucial importance in supporting those experiencing poverty and disadvantage in our communities. The introduction of the Coronavirus Supplement allowed recipients for the first time in many years to be able to meet this basic, adequate standard of living.

1 Aboriginal Peak Organisations Northern Territory, Fair work and Stronger Communities Proposal, May 2017, available at file:///C:/Users/TessaSnowdon/Downloads/Proposal-for-Remote-Development-and-Employment-Scheme.pdf

2 Australian Council of Social Service (ACOSS), Media Release “Community Service workers warn of dire consequences of planned cuts to

JobSeeker”, 26 August 2020, Strawberry Hills NSW

3 Australian Council of Social Service (ACOSS) and the University of NSW Sydney (UNSW Sydney), Poverty in Australia 2020, Part 1: Overview, Strawberry Hills NSW

4 Australian Government, Australian Law Reform Commission, 2012 ‘Australia’s social security system’, September 2019, https://www.alrc.gov.au/publication/grey-areas-age-barriers-to-work-in-commonwealth-laws-dp-78/5-social-security/australias-social- security-system/

5 Australia Government – Attorney – General’s Department, ‘Right to an adequate standard of living, including food, water and housing’

Without the introduction of the Coronavirus Supplement and JobKeeper payments, an additional 2.2 million Australians would have entered into poverty during the pandemic.6 Conversely, its introduction has instead resulted in a marked decrease in the number of Australians living in poverty.7 The impact a reduction in the Coronavirus Supplement will have on recipients, as well as the economy, cannot be understated.

Nationally, modelling released in September found that the complete cessation of the Coronavirus Supplement in December would reduce the national economy by $31.3 billion, and see an average loss of 145,000 Full-Time Equivalent jobs over the same two year period.8 While NTCOSS commends the Government on extending the Coronavirus Supplement, any reduction will still have negative impacts on our economy, as well as the wellbeing of those receiving the payment. Deloitte Access Economics has established that every dollar that the Government invests in JobSeeker generates significant economic return, with analysis showing that the Government’s reductions to income support would set the economy back in a time of recession.9

In the NT alone, with the reduction in the Coronavirus Supplement in September, 33, 835 Supplement recipients began receiving $300 less per fortnight, a loss of around $10 million to the NT economy in the same period.10 The Federal electorate of Lingiari, the electorate with the largest proportion of working-age population in receipt of income support payments in Australia (19.5% June 2020),11 experienced the majority of this financial loss with $7 million per fortnight taken from the economy, impacting largely rural, regional and remote populations.12 The proposed further reductions to the supplement to take effect in December would remove another $3.4 million per week from the Territory’s economy, again, mostly felt in rural, regional and remote communities.

Of the poverty rates in Australia, people living in Remote or Very Remote localities experience much higher levels of poverty than those living in urban centres.11 These high rates of poverty are experienced disproportionately across the NT, with Aboriginal people in particular overrepresented in homelessness and unemployment rates, and poor educational outcomes.

6 Philips et al 2020; Phillips, B., Gray, M., and Biddle, N. (Australian National University Centre for Social Research and Methods 2020, COVID-19 JobKeeper and JobSeeker impacts on poverty and housing stress under current and alternative economic and policy scenarios, Australian National University, August 2020

7 Ibid.

8 Deloitte Access Economics, Estimating the economic impacts of lowering current levels of income support payments, Australian Council of Social Service, September 2020 available at https://www.acoss.org.au/wp-content/uploads/2020/09/Final-ACOSS-Coronavirus- Supplement-to-ACOSS-09.09.2020.pdf

9 NTCOSS, Media Release: Cuts to JobSeeker to cost the NT economy $348 million – Deloitte report, September 2020, available at https://ntcoss.org.au/category/media-releases/

10 Australian Government, DSS Payment Demographic Data, September 2020, accessed September 2020, available at https://data.gov.au/dataset/ds-dga-cff2ae8a-55e4-47db-a66d-e177fe0ac6a0/details?q=dss

11 Parliament of Australia, The impact of COVID-19 on JobSeeker Payment recipient numbers by electorate, September 2020, viewed November 2020, available at https://www.aph.gov.au/About_Parliament/Parliamentary_Departments/Parliamentary_Library/pubs/rp/rp2021/COVID- 19JobSeekerRecipientNumbersElectorateUpdate#_Toc49850898

12 Australian Government 2020e, Senate Select Committee on COVID-19 ANSWER TO QUESTION ON NOTICE Department of Social Services Topic: Senate Select Committee on COVID-19 – SQ20-000426 Weekly Update Question reference number: SQ20-000500, Type of Question: Written. Hansard Page/s: July 2020, Canberra ACT, p.5-6,36-37. file:///C:/Users/JP/Downloads/222.%20AQoN_Social%20Services_29092020.pdf

The lack of any real increase to base rates of income support payments on Territory communities is identified in NTCOSS Cost of Living reports; remote areas are unfairly burdened by high costs relating to transport13 and increased rental costs,14 prices have increased in key expenditure areas (such as utilities, education and health) and those living in the region (and in particular in remote localities) pay substantially higher rates for produce and other food items.15 As a result, vulnerable people face further challenges with damaging effects on people’s, health, social wellbeing and long term security, and poverty and disadvantage are becoming further entrenched in our communities.

Along with the measurable economic benefits that come with higher payment rates of social security, increasing the rate of payments would have positive impacts in numerous other areas. The Health of Disability Support Pension and Newstart Allowance Recipients report by Monash University found that there is a significantly increased burden of ill health within the cohort of Australian Newstart recipients (and DSP recipients) compared to employed people of working age.16 Poverty and financial pressure directly correlate to poor health outcomes and the reduced ability to engage and participate in employment. Health (and in particular mental health) can be improved by reducing the burden of engaging with Government.17

NTCOSS supports the extension of Coronavirus Support through the continuation of the Coronavirus Supplement from 1 January to 31 March 2021, however recommends that the rate of the Supplement be returned to $550 per fortnight over this period. Further, NTCOSS recommends that the rate of JobSeeker, Youth Allowance and other related payments be increased permanently and adequately beyond this period as recommended by ACOSS through the Raise the Rate for Good Campaign. Additionally, in relation to the NT, NTCOSS recommends that the Government remove punitive measures that unfairly impact and stigmatise cohorts within the Territory (as referred in the submission to the inquiry into the Adequacy of Newstart and related payments and alternative mechanisms to determine the level of income support payments in Australia 2019 (Attachment A), and submission to the Senate Community Affairs Legislation Committee on the Social Security (Administration) Amendment (Continuation of Cashless Welfare) Bill 2020 (Attachment B)), and instead focus on investing in programs that benefit communities and address rates of unemployment in a meaningful way (such as through the abolishment of the Community Development Program and adoption of the Fair Work and Stronger Communities Proposal).

Yours sincerely,

Deborah Di Natale CEO

13 NTCOSS, 2018 Cost of Living Report – Issue 21 14 NTCOSS, 2019, Cost of Living Report – Issue 23 15 NTCOSS, 2019, Cost of Living Report – Issue 24

16 Prof. A. Collie, 2019, The Health of Disability Support Pension and Newstart Allowance Recipients, Monash University

17 Ibid.

NTCOSS Submission to the Senate Inquiry into the Adequacy of Newstart and Related Payments and Alternative Mechanisms to Determine the Level of Income Support Payments in Australia

September 2019

NORTHERN TERRITORY COUNCIL OF SOCIAL SERVICE INC (NTCOSS)

The Northern Territory Council of Social Service (NTCOSS) welcomes the opportunity to respond to the Senate and Community Affairs References Committee inquiry into the adequacy of Newstart and related payments, and alternative mechanisms to determine the level of income support payments in Australia.

NTCOSS is a peak body for the social and community service sector in the Northern Territory (NT), and an advocate for social justice on behalf of the people and communities who may be affected by poverty and disadvantage. The community sector in the NT is made up of community managed, non- government, not for profit organisations that work in social and community service delivery, sector development and advocacy. The community sector plays a vital role in creating social wellbeing for all Territorians and in building safe and healthy communities by providing services that enable people to access and participate in health services, education, employment, economic development, and family and community life.

NTCOSS’ vision is for a ‘fair, inclusive and sustainable NT where all individuals and communities can participate in and benefit from all aspects of social, cultural and economic life’. NTCOSS’ mission is to ‘promote an awareness and understanding of social issues through the NT community and to strive towards the development of an equitable and just society’.

Introduction

NTCOSS represents a varied service sector, with members bringing different experiences and perspectives from across the region. The diversity of the social and community sector across the NT is in part a response to meeting the changing needs of a complex and culturally diverse population. For example;

- The NT has the highest proportion of Aboriginal and Torres Strait Islander peoples in Australia;1

- Twenty per cent of the NT population was born overseas;2

- More than 100 Aboriginal languages and dialects are spoken in the NT;3

- The NT has the highest rate of people experiencing homelessness in Australia; and4

- The NT has the deepest poverty rates, with nearly 45% of all Aboriginal households living below the poverty line.5

The primary purpose of Australia’s social security system is to provide individuals with a ‘minimum adequate standard of living’.6 This includes adequate food, water and housing and to the continuous improvement of living conditions.7 Ensuring the adequacy of social security payments to assist individuals in meeting this standard is of crucial importance in supporting those experiencing poverty and disadvantage in our communities.

Newstart is one of the critical support payments available to individuals who are experiencing unemployment or looking for work. The rate of Newstart, however, has not been increased in 25 years, while the cost of living has continued to climb. The NTCOSS Cost of Living reports identity how this increase particularly impacts those living in the NT; remote areas are unfairly burdened by high costs

relating to transport8 and increased rental costs,9 prices have increased in key expenditure areas (such as utilities, education and health) and those living in the region (and in particular in remote localities) pay substantially higher rates for produce and other food items.10 As a result of this, vulnerable people face further challenges with damaging effects on people’s, health, social wellbeing and long term security, and poverty and disadvantage are becoming further entrenched in our communities.

1 Australian Bureau of Statistics, 2016 Census QuickStats, Northern Territory https://quickstats.censusdata.abs.gov.au/census_services/getproduct/census/2016/quickstat/7?opendocument accessed 18th June 2019 2 ibid

3 Aboriginal languages in NT https://nt.gov.au/community/interpreting-and-translating-services/aboriginal-interpreter-service/aboriginal- languages-in-nt, accessed 18th June 2019

4 Australian Bureau of Statistics, Census of Population and Housing: Estimating homelessness, 2016 https://www.abs.gov.au/ausstats/abs@.nsf/mf/2049.0

5 Land Rights News – Northern Edition in School of Regulation and Global Governance, 2017, ‘Deepening Indigenous poverty in the

Northern Territory’, Australian National University http://regnet.anu.edu.au/news- events/news/7002/deepening-indigenous-poverty-northern-territory

6 Australian Government, Australian Law Reform Commission, 2012 ‘Australia’s social security system’, September 2019, https://www.alrc.gov.au/publication/grey-areas-age-barriers-to-work-in-commonwealth-laws-dp-78/5-social-security/australias-social- security-system/

7 Australia Government – Attorney – General’s Department, ‘Right to an adequate standard of living, including food, water and housing’ viewed September 2019, https://www.ag.gov.au/RightsAndProtections/HumanRights/Human-rights- scrutiny/PublicSectorGuidanceSheets/Pages/Righttoanadequatestandardoflivingincludingfoodwaterandhousing.aspx

8 NTCOSS, 2018 Cost of Living Report – Issue 21

9 NTCOSS, 2019, Cost of Living Report – Issue 23

10 NTCOSS, 2019, Cost of Living Report – Issue 24

‘The need to break cycles of disadvantage and promote development for Aboriginal people (is) particularly acute in remote and very remote regions of the Northern Territory. These areas experience the lowest median incomes, highest rates of poverty, and the highest rates of income inequality in the country as compared to non-Indigenous people.’11

Considering the high rate of poverty and homelessness experienced in the NT, addressing the inadequacy of Newstart and other payments, along with issues regarding access and engagement, is of crucial importance. The Australian Government must strive for a social security system that is not only strengths based, but supports access, engagement and equity for all.

Current inadequacy of payments

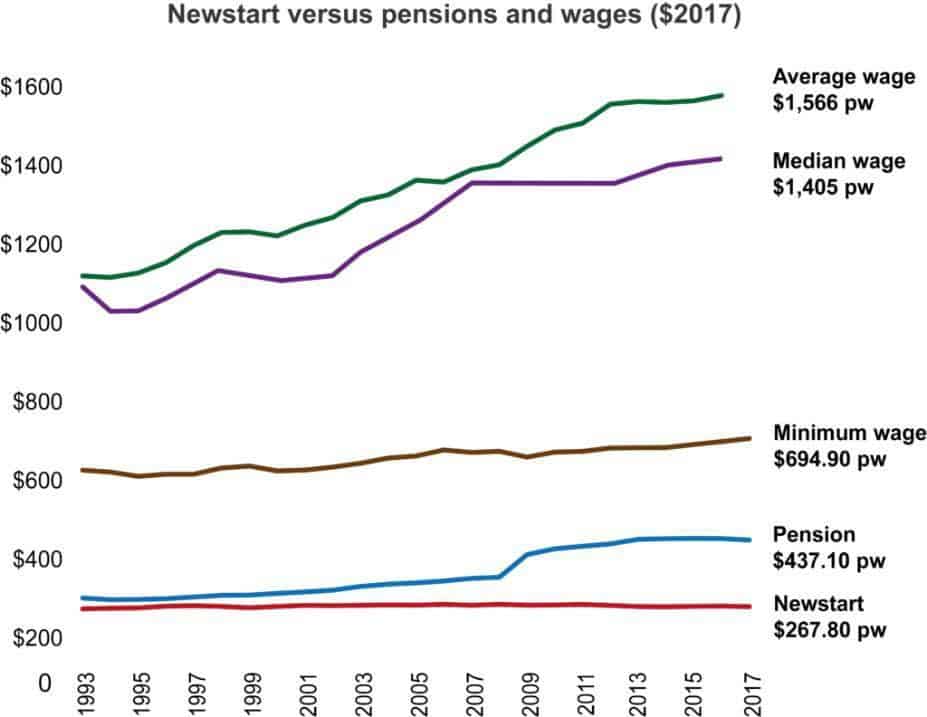

The current weekly single rate of Newstart is $278, with this equating to an annual amount of $14,456 or less than $40.00 per day. Newstart recipients receive $175 less per week than the pension, and their payment is 40% less than the minimum wage in Australia.12 The NT has the highest proportion of Newstart recipients (relative to population) than any other state or territory in Australia.13

The below table taken from the ABS monthly Labour Market and Related Payments profile for July 2019, demonstrates that the number of people on Newstart and Youth Allowance in regional and remote areas is increasing.

| Variation | |||

| State by SA3 | June 2019 | July 2019 | |

| % | |||

| Northern Territory | |||

| Alice Springs | 3,703 | 3,754 | 1.4% |

| Barkly | 922 | 927 | 0.5% |

| Daly – Tiwi – West Arnhem | 2,772 | 2,746 | -0.9% |

| Darwin City | 546 | 553 | 1.3% |

| Darwin Suburbs | 1,324 | 1,249 | -5.7% |

| East Arnhem | 1,751 | 1,784 | 1.9% |

| Katherine | 2,456 | 2,494 | 1.5% |

| Litchfield | 437 | 437 | 0.0% |

| Palmerston | 965 | 924 | -4.2% |

*SA3 data is derived using the Australian Statistical Geography Standard (ASGS 2011) from the Australian Bureau of Statistics.

11 Reference from paper – Francis Markham and Nicholas Biddle, “Income, Poverty and inequality,” 2016 Census paper (Canberra: Centre

for Aboriginal Economic Policy research, ANU, 2018).

12 Australian Council of Social Service (2018c) Raise the Rate – Everyone benefits, Fact Sheet, Mar 2018 https://www.acoss.org.au/wp- content/uploads/2018/03/Raise-the-rate_fact-sheet_29032018.pdf

13 Deloitte Access Economics, 2018, Analysis of the impact of raising benefit rates – Australian Council of Social Service

The Australian Bureau of Statistics (ABS) reports that the rate of increase in the cost of living for people on Centrelink Income Support Payments has risen at a faster rate than the rise of payments, especially for single Newstart recipients with children. This higher cost of living is attributed to the types of goods people are purchasing; people on Newstart are prioritising the purchase of essential goods and services (such as housing), which are also the necessary services which costs are rising at a higher rate.14

Figure 1 ACOSS (2018c)

Case studies supplied to NTCOSS (Appendixes A-E) provide examples of how this inadequacy severely impacts on individual wellbeing. Common themes in these case studies are:

- Due to the rising costs of living and the prioritising of essential goods and services (such as housing and transport), people often make significant sacrifices in other areas (food, social support, medical).

- To maintain payments, maintaining housing and transport is crucial – if any unforeseen costs arise and people cannot maintain their ability to find work, use a phone, access the internet to engage with job seeking services and report appropriately to Centrelink, they are at risk of being breached and having their payment quarantined. If this occurs, and they cannot afford to pay rent on their home, they are at risk of entering into homelessness. This is particularly concerning for those living in public housing, where people often sit on a waitlist for up to 10 years to access appropriate accommodation.

Access and breaches

In order to access social welfare, service users must navigate complex and opaque systems, with significant impacts. These systems can often have the effect of impeding an individual’s ability to maintain their payment through restrictive and demanding reporting requirements, with punitive measures for non-compliance that have significant impacts on wellbeing.

14 Australia Bureau of Statistics, Consumer Price Index, 2019

ABC, ‘Newstart recipients’ standard of living going backwards, ABS data confirms’, viewed September 2019,

These onerous conditions have a substantial effect on people’s mental health, with the psychological impacts of applying for benefits and complying with bureaucratic processes found to be significant.15 Further, those with pre-existing conditions (such as cognitive or intellectual impairments) are often those with less education, smaller social support networks and other vulnerabilities, and are more likely to be adversely affected by such programs.16

‘The Auntie caring for the youngest two children is on Centrelink payments… (and) has health issues including kidney disease and a heart condition. Often she was unable to meet her job network requirements due to her health issues, resulting in payments being suspended…. When payments are suspended this adds an additional burden to already vulnerable families’. – Appendix A

Breaches

The recent review of CDP found that its participants are the most penalised group of social security recipients. There are around 35,000 participants in CDP, of which roughly 80% are identified as Aboriginal and/or Torres Strait Islander and living in remote communities.17 These Aboriginal CDP participants are 25 times more likely to be penalised than non-remote job seekers, and 50 times more likely to have a penalty imposed on them for ‘persistent non-compliance’ (up to 8 weeks).18

In conjunction with this, navigating the Centrelink system reportedly contributes to stress, anxiety and mental health problems for job seekers.19 Tangentyere Council has previously identified that this high level of breaching is related to the significant level of participation required from remote income support recipients. 20

This considerable breach rate, in conjunction with negative associations with the Centrelink system, mean that a high number of people in remote communities are not receiving income support or engaging with the social welfare system. This failure impacts pointedly upon vulnerable families and individuals, and often means that people are forced to seek financial support from family members who are rarely equipped to provide it.

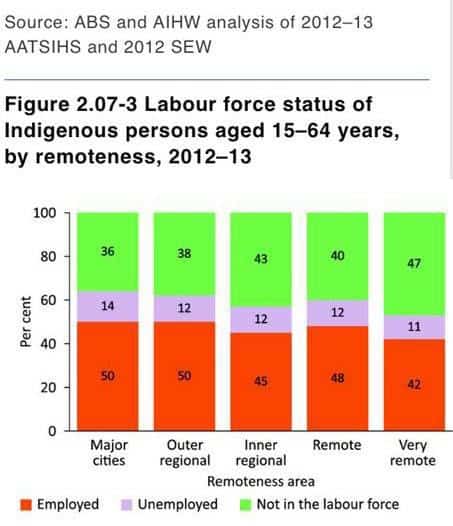

The below graph demonstrates a high percentage of individuals in remote localities are listed as ‘not in the labour force’. It can be extrapolated that those identified as not partaking in the labour force are not receiving any income at all21 and there is a likely correlation between this high rate of disengagement and the high rates of poverty experienced in the NT.22

15 Prof. A. Collie, 2019, The Health of Disability Support Pension and Newstart Allowance Recipients, Monash University, available at https://www.afdo.org.au/wp-content/uploads/2019/09/03A-DSP-NSA-Health-Study.pdf

16Collie, 2019, The Health of Disability Support Pension and Newstart Allowance Recipients

17 Department of the Prime Minister and Cabinet, ‘An evaluation of the first two years of the Community Development Programme’,

accessed at https://www.pmc.gov.au/sites/default/files/publications/cdp-evaluation-first-2-years.pdf

18 The Guardian, Work for the Dole an ‘intergenerational time bomb’ for Indigenous Communities, viewed September 2019, accessed at https://www.theguardian.com/australia-news/2018/oct/11/work-for-the-dole-an-intergenerational-time-bomb-for-indigenous- communities

19 Australian Government, National Indigenous Australian Agency, 2019, ‘The many pathways of the Community Development

Programme’

20 Tangentyere Council, 2017, submission to the Senate Finance and Public Administration Committee Inquiry into the appropriateness and effectiveness of the objectives, design, implementation and evaluation of the Community Development Program

Central Australian Youth Link Up Service (CAYLUS), 2019, submission to the Productivity Commission Inquiry into the Expenditure on Children in the NT; and

Central Australian Aboriginal Congress (CAAC), Appendix A

Access

Key to addressing the high rate of breaches in the NT, along with lack of engagement with social welfare, is addressing the numerous access issues people face when engaging with the various systems in place around payments.

The onus is on the individual to ‘prove’ their ongoing eligibility for receiving a payment, which not only includes meeting Centrelink reporting requirements, but engaging with third party providers of job seeker programs. Complexities around meeting these rigid requirements are exacerbated in a rural and remote setting.

These access issues include;

- Centrelink access (on site) is limited for those not in urban spaces – while Centrelink agents are situated in various communities, they have limited access to Centrelink’s online systems. Where individuals require one on one engagement for assessments (such as Employment Assessment Services for the CDP) or need extra support to navigate the system, they are forced to travel to urban centres to visit a Centrelink office or wait until the remote Centrelink team visits their community.

- The inability to access appropriate assessments means that many individuals have to engage with programs (such as having to meet greater requirements regarding hours of work) at a much higher level than they otherwise may have to if an appropriate assessment occurred.

- There are often significantly long wait times to the Centrelink call centre, which is a significant issue for people experiencing financial hardship and may not be able to afford to own or maintain a mobile telephone. Where people are forced to visit a provider or support service to use a telephone, this adds another obstacle to the process, particularly when taking into account transport issues (such as distance from public transport/lack of public transport, cost of taxi, etc).

- The reliance on myGov is a significant barrier for people in remote localities where access to computers and reliable internet connection is limited, and is a particular issue for people with low computer literacy.